Analyzing Ginnie Mae Distressed Loans: A Rising Challenge in Senior Housing

At RealAssetData we go deep into our coverage of the Senior Housing sector. Amidst today's challenging economic climate, we've recognized the need to explore and share more concerning trends we observe within the Ginnie Mae pools. As background, Ginnie Mae is a government agency that guarantees timely payments on ~$153b mortgage-backed securities. While industry data platforms might downplay these issues, a chat with a special servicer managing Ginnie Mae pools would likely confirm the cracks in Senior Housing. Over the past year, since we started tracking Ginnie Mae data, delinquencies have steadily increased, raising alarm bells around Senior Housing sector. The raw data tells a compelling story, revealing the states most impacted by this trend.

Steady Increase in Delinquency

The data highlights a steady rise in both the loan count and the current balance of delinquent loans over the past year. Here are some key figures from the past 15 months:

- May 2023: 130 delinquent loans, with a total balance of $1.03 billion.

- September 2023: 161 delinquent loans, totaling $1.22 billion.

- December 2023: 207 delinquent loans, with a balance of $1.68 billion.

- June 2024: 229 delinquent loans, totaling $1.92 billion.

- July 2024: 225 delinquent loans, with a balance of $1.89 billion.

This upward trajectory indicates not only a growing number of delinquent loans but also increasingly larger loan balances in arrears, reflecting more significant financial distress.

Senior Housing: The Epicenter of Delinquencies

When breaking down the data by property type, it's evident that Senior Housing is facing the most severe challenges:

Senior Housing:

- Loan Count: 189

- Current Balance: $1.39 billion

Multifamily:

- Loan Count: 36

- Current Balance: $497.4 million

The Senior Housing sector is clearly under significant pressure, with nearly four times the delinquent loan count and almost three times the delinquent balance compared to the multifamily sector. This disparity suggests that Senior Housing facilities are particularly vulnerable to the economic and operational stresses currently affecting the market.

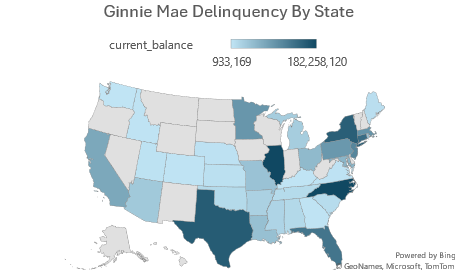

Geographic Concentration of Delinquencies

The data also reveals that specific states are bearing the brunt of these delinquencies. The states with the highest delinquent balances are:

Illinois (IL):

- Loan Count: 31

- Current Balance: $182.3 million

North Carolina (NC):

- Loan Count: 45

- Current Balance: $181.6 million

Texas (TX):

- Loan Count: 16

- Current Balance: $159.1 million

Connecticut (CT):

- Loan Count: 17

- Current Balance: $140.2 million

New York (NY):

- Loan Count: 12

- Current Balance: $155.4 million

These states represent the most significant concentrations of delinquent balances, particularly in the Senior Housing sector. The high loan counts and substantial balances suggest that localized economic conditions, coupled with state-specific regulatory and market environments, are playing critical roles in exacerbating delinquency issues.

Implications for Stakeholders

For investors and stakeholders in the real estate market, these trends highlight several critical considerations:

Sector-Specific Risks: Senior Housing is under disproportionate stress, requiring a focused approach to risk management and potential adjustments in investment strategies.

State-Specific Factors: The geographic concentration of delinquencies in states like Illinois, North Carolina, and Texas suggests that investors should closely monitor state-specific economic and regulatory developments.

Future Projections: With delinquencies steadily rising, there may be further implications for the broader real estate market, particularly if these trends continue into the next fiscal year.

Conclusion

The rise in Ginnie Mae delinquencies over the past year, particularly within the Senior Housing sector, signals growing challenges in the commercial real estate market. As the data shows, the situation is particularly acute in states like Illinois, North Carolina, and Texas. For investors, these trends underscore the importance of staying informed and proactive in managing risks associated with Ginnie Mae-backed securities. The next few months will be crucial in determining whether these delinquency trends stabilize or continue to escalate, potentially influencing broader market dynamics and investment strategies.

Disclaimers:

- In analyzing the performance of Senior Housing assets within Ginnie Mae pools, it’s important to note that our categorization of these properties is based on disclosures from underlying loan insurers. This approach ensures that we accurately reflect the nature of the assets as Senior Housing rather than broadly labeling them as 'Multifamily,' which some data providers may do. In our view, assigning accurate Property Types is critical, as it allows for a more precise assessment of risk and performance specific to Senior Housing, an asset class with unique financial characteristics and vulnerabilities.

- All information contained on the website of CREKONNEKT LLC d/b/a RealAssetData (https://realassetdata.com) is protected by U.S. copyright law. Any reproduction or redistribution of this report to a non-subscriber, inside or outside of your firm (if applicable), without the prior written consent of CREKONNEKT LLC is strictly prohibited. The information provided by CREKONNEKT LLC is derived from sources believed to be reliable as of the time of collection; however, it is provided "as is" without any warranty of any kind. CREKONNEKT LLC does not guarantee the accuracy, timeliness, completeness, merchantability, or fitness for any particular purpose of this information. CREKONNEKT LLC is not a broker or investment advisor and does not provide investment advice or recommendations. The information and analysis provided are intended for informational purposes only and should not be considered financial advice. Users are strongly encouraged to conduct independent research and consult with a qualified financial professional before making any investment decisions. By using this information, you agree to these terms and conditions and acknowledge that CREKONNEKT LLC, its affiliates, and its personnel will not be held liable for any errors, inaccuracies, or any damages arising from the use of this information. This includes any direct, indirect, special, consequential, or incidental damages, even if advised of the possibility of such damages. We reserve the right to update this disclaimer at any time.

Powered by Froala Editor

2025-04-07 23:29:35

2025-04-07 23:29:35